Introduction to Banking

Banking is a fundamental component of the financial system, serving as a pivotal intermediary between savers and borrowers. At its core, banking is defined as the business of accepting deposits from customers and providing loans to those in need of financing. This vital service facilitates not only individual financial activities but also plays a crucial role in the broader economy by promoting investment and consumption.

The purpose of banking extends beyond mere transaction facilitation; it encompasses the management of financial risks and the provision of a secure environment for monetary assets. By offering services such as savings accounts, checking accounts, and various types of loans, banks contribute to the stability and growth of financial ecosystems. History reveals that banking practices can be traced back to ancient civilizations, where merchants engaged in rudimentary forms of banking involving the exchange and storage of commodities.

The evolution of banks from these early practices to modern financial institutions highlights significant advancements in the industry. In ancient Mesopotamia, for example, temples and palaces served as depositories for grains and precious metals, establishing the basic principles of safeguarding and lending. As society progressed, formalized banking emerged in Mediterranean civilizations, particularly during the medieval period with the introduction of bills of exchange and promissory notes.

Fast forward to the 20th and 21st centuries, banks have undergone transformative changes due to innovations in technology and regulatory frameworks. Today, financial institutions not only provide traditional banking services but also engage in complex financial activities, including investment banking, wealth management, and digital banking solutions. The continued growth of online banking and financial technology illustrates how the banking sector is adapting to meet the changing needs of consumers and businesses alike.

Types of Banks

The banking sector is composed of various types of banks, each serving distinct roles in the financial landscape and catering to specific customer needs. Understanding these different types of banks is essential for consumers and businesses alike, as it helps in selecting the right institution for their financial requirements.

Commercial banks are perhaps the most familiar type of bank to the public. They offer a range of services, including savings and checking accounts, loans, credit cards, and mortgages. Typically, these banks cater to individuals, businesses, and corporations, making them the primary choice for personal banking needs. They generate profits through interest on loans and fees for services.

Investment banks, on the other hand, operate primarily within the capital markets. Their main functions include underwriting new debt and equity instruments, assisting companies in mergers and acquisitions, and providing market-making services. Unlike commercial banks, investment banks do not usually offer traditional banking services to the general public; instead, they focus on securing financing for corporations and high-net-worth individuals.

Savings and loan associations, which are often referred to as thrifts, play a unique role by primarily offering home mortgage loans and accepting deposits. Their primary focus is on providing affordable housing finance solutions to their customers. These institutions operate within a structure that prioritizes savings and home ownership, making them an important player in residential financing.

Credit unions are not-for-profit institutions owned by their members. They are designed to offer competitive rates on loans and savings products to their members while promoting a community-oriented approach. Credit unions often provide personalized services and are an excellent option for individuals seeking lower fees and favorable terms.

Finally, central banks are government-owned entities responsible for managing a country’s monetary policy, including interest rates and inflation control. By regulating the money supply and acting as a lender of last resort, central banks ensure the stability of the financial system and facilitate economic growth. Each type of bank, therefore, plays a significant role within the financial ecosystem, serving diverse populations and fulfilling various functions.

The Structure of the Banking System

The banking system serves as a crucial component of any economy, facilitating the flow of money and providing essential services to individuals and businesses. Its structure is composed of various types of financial institutions, each playing distinct roles. At its core are commercial banks, which manage deposits, offer loans, and provide other financial services. These institutions are typically organized into various categories, including retail banks, investment banks, and community banks, catering to different segments of the market.

In addition to commercial banks, the banking system includes several other types of institutions, such as credit unions, savings and loan associations, and development banks. Each of these entities operates under specific regulatory guidelines, ensuring they adhere to legal and financial standards. The organization of the banking system is not only about the types of banks but also about their hierarchical nature, which can be seen in larger financial conglomerates that may encompass multiple banking services and investment operations.

The regulation of the banking system is vital for maintaining financial stability and protecting consumers. Regulatory bodies, such as the Federal Reserve in the United States and the Prudential Regulation Authority in the UK, oversee the banking operations, ensuring that banks maintain adequate capital reserves, manage risks appropriately, and comply with legal requirements. These regulations are designed to prevent bank failures and maintain the public’s trust in the banking institution. A stable banking system fosters economic growth, facilitates efficient monetary policy implementation, and safeguards the financial system against crises. Thus, the structure and regulation of banks are integral to a well-functioning economy, enabling both individual prosperity and broader economic stability.

Banking Services Offered

Banks play a pivotal role in the financial landscape, offering a variety of services that cater to the needs of individuals and businesses alike. Understanding these services is essential for effective financial planning and management. Among the most common offerings are savings accounts, checking accounts, loans, mortgages, investment services, and online banking.

Savings accounts are a fundamental banking service that allows customers to earn interest on their deposits while providing a safe place to store funds. They are ideal for individuals looking to save for future needs, emergencies, or specific goals. Checking accounts, on the other hand, facilitate daily transactions, allowing customers to make deposits, withdrawals, and payments conveniently. These accounts typically come with features like debit cards and online payment options, enhancing the ease of managing personal finances.

Loans are another critical aspect of banking services, enabling consumers and businesses to access funds for various purposes. Personal loans, auto loans, and student loans serve individual needs, while business loans support entrepreneurial ventures and expansion. Mortgages, which are loans specifically for purchasing real estate, involve a long-term commitment but are vital for home ownership and investment.

In addition to traditional banking services, banks increasingly offer investment services, providing customers with opportunities to grow their wealth through stocks, bonds, and mutual funds. This diversification is essential for building a robust financial portfolio. Furthermore, the rise of digital banking has transformed how consumers interact with their banks. Online banking offers 24/7 access to accounts, allowing for seamless transaction management, bill payments, and account monitoring, thus enhancing convenience.

The importance of these banking services cannot be overstated, as they are integral to financial stability and growth for individuals and businesses. Access to various services allows for better cash management, investment opportunities, and financial security, ultimately contributing to economic well-being.

How Banks Make Money

Banks primarily earn income through various channels, with the most significant being interest from loans. When banks provide loans to individuals or businesses, they charge an interest rate that is typically higher than the rate they offer on deposits. This difference, known as the net interest margin, plays a crucial role in the profitability of banks. The net interest margin is essentially the spread between the interest income generated and the interest expenses incurred from depositors. When interest rates are favorable, banks can widen this margin, enhancing their earning potential.

In addition to interest income, banks also generate revenue through various fees for services. These can include account maintenance fees, transaction fees, overdraft fees, and charges for services like wire transfers. Fees are an essential component of a bank’s income strategy, allowing institutions to diversify their revenue streams and reduce dependence on loan interest alone. Moreover, the nature and structure of these fees can impact customer retention and satisfaction; hence, banks often strive to find a balance between profitability and customer service.

Investment returns also contribute to how banks make money. Many banks invest in government and corporate bonds, equity markets, or other financial instruments. The returns from these investments can significantly enhance a bank’s income, especially when the capital markets are performing well. However, the performance of these investments can be volatile, influenced by market conditions, interest rate fluctuations, and economic cycles. Understanding the interplay of these factors is essential for assessing a bank’s overall financial health.

In conclusion, banks utilize a combination of interest income, fees, and investment returns to create revenue. The efficiency with which they manage their assets and liabilities, especially under varying interest rate conditions, directly influences their profitability and overall sustainability in the financial sector.

The Role of Technology in Banking

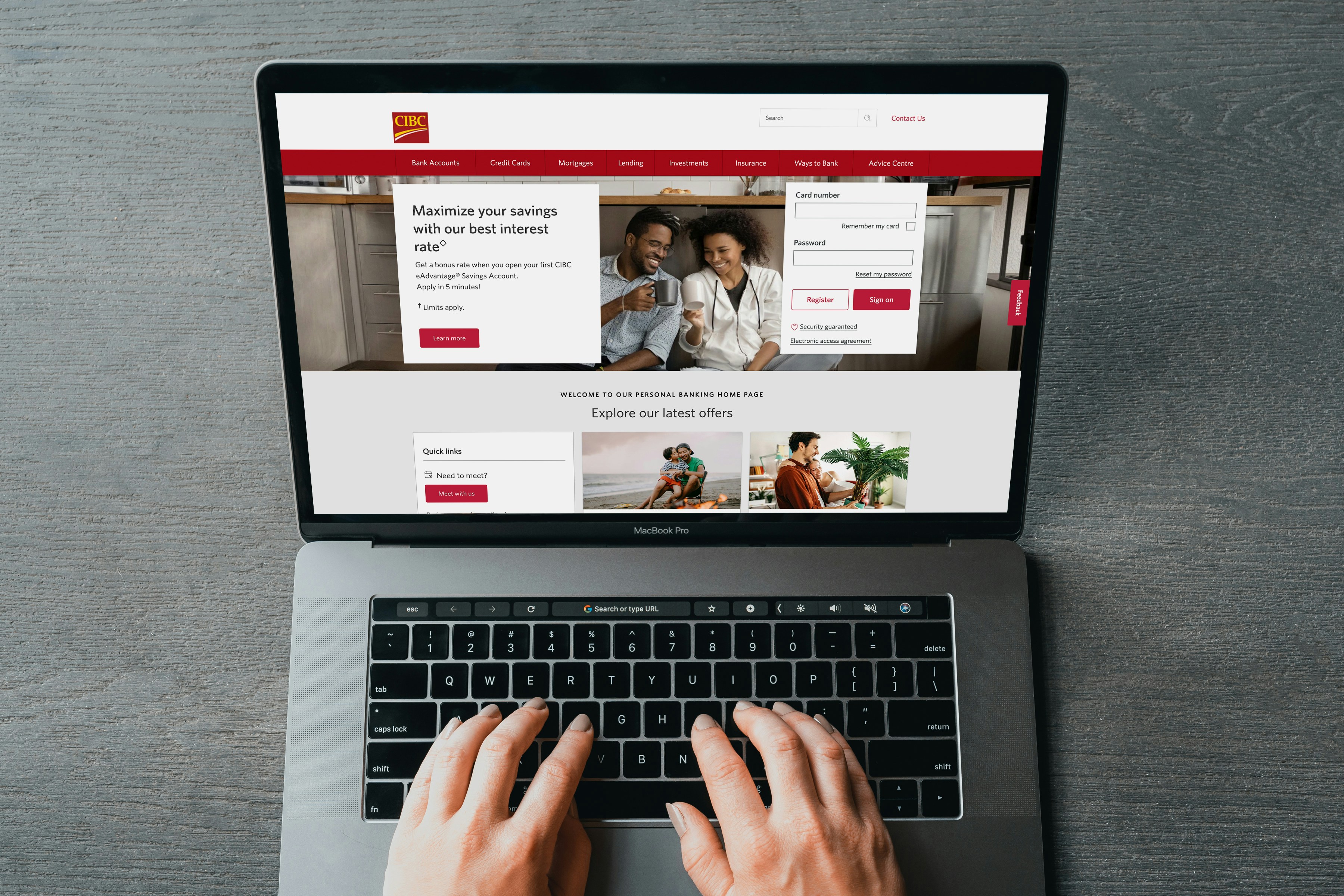

In recent years, technology has significantly transformed the banking landscape, reshaping how financial institutions operate and how customers engage with their services. The advent of online banking marked a turning point, allowing customers to manage their accounts, transfer funds, and pay bills from the comfort of their homes, thereby enhancing convenience and accessibility. This shift has empowered consumers with greater control over their finances while simultaneously reducing the burden on traditional banking infrastructure.

Mobile applications have further revolutionized the banking experience, providing users with instant access to various financial services. These applications often include features such as biometric authentication, which enhances security, as well as personalized financial management tools that help customers track spending and savings. The proliferation of mobile banking has been particularly impactful in reaching unbanked and underbanked populations, who can now access essential financial services through their smartphones.

Fintech companies have emerged as significant players in this evolving landscape, offering innovative solutions that challenge traditional banks. These firms leverage advanced technologies to deliver faster, more efficient services, often focusing on specific areas such as peer-to-peer lending, robo-advisory, and payment processing. Consequently, established banks are increasingly collaborating with fintechs to remain competitive and enhance their service offerings.

Blockchain technology is another critical component changing the banking sector. Its decentralized nature offers enhanced security and transparency for transactions, which can help mitigate fraud and streamline processes. Several banks are exploring blockchain applications to improve cross-border payments and identity verification, indicating its potential to reshape operability in the industry.

Additionally, the rise of digital-only banks, often referred to as neobanks, has introduced a new model that caters to tech-savvy consumers who prefer entirely online banking solutions. These institutions often boast lower fees and fewer overhead costs, attracting customers through their user-friendly interfaces and innovative features.

Overall, technology’s integration into banking not only improves operational efficiency but also significantly enhances the customer experience, fostering a more personalized and responsive banking environment.

Challenges Facing the Banking Sector

The banking sector is currently navigating a myriad of challenges that threaten its stability and growth. One of the most pressing issues is cybersecurity threats. As technological advancements proliferate, so too do the methods employed by cybercriminals. Banks are increasingly becoming targets for cyberattacks, which can lead to significant financial loss and damage to reputation. Ensuring robust cybersecurity measures is essential for protecting sensitive customer information and maintaining trust.

Regulatory compliance presents another challenge for banks. The financial sector is subject to a complex web of regulations that can vary significantly by region. Striking a balance between adhering to these regulations and pursuing profit can be intricate. Failure to comply can result in heavy fines and legal repercussions, necessitating banks to invest substantially in compliance departments and training programs.

Economic fluctuations further complicate the operational landscape for banks. Changes in interest rates, inflation, and economic downturns can impact lending practices and the overall profitability of financial institutions. To mitigate these risks, banks must develop robust financial strategies that allow them to adapt quickly to a dynamic economic environment.

Public trust is equally crucial in the banking sector, especially in light of recent financial crises that have shaken confidence in traditional banking models. Building and preserving this trust requires transparency in operations and effective communication with clients.

Lastly, competition from fintech startups has intensified the challenges faced by banks. These technology-driven companies often offer personalized services at lower costs, attracting customers who may prefer innovative solutions over conventional banking methods. In response, banks are encouraged to embrace technological advancements, enhance customer experience, and consider partnerships with fintech firms to remain competitive.

Addressing these multifaceted challenges necessitates a strategic approach that incorporates innovation, regulation compliance, cybersecurity measures, and maintaining robust public relations to ensure sustainability in an ever-evolving banking landscape.

The Future of Banking

The banking industry is on the brink of transformative change as it adapts to emerging technologies, evolving consumer preferences, and the pressing need for sustainability. One of the most significant advancements shaping the future of banking is the integration of artificial intelligence (AI). AI technologies are streamlining operations, enhancing customer service through chatbots, and providing more accurate credit assessments. These innovations not only improve efficiency but also offer personalized banking experiences, catering to individual customer needs through data-driven insights.

Additionally, the trend toward sustainable banking is gaining momentum, driven by a global shift toward environmental responsibility. Financial institutions are increasingly recognizing the importance of incorporating sustainability into their operational frameworks. This includes offering green financial products, investing in renewable energy projects, and adopting eco-friendly practices. As consumers become more environmentally conscious, their banking choices will increasingly reflect their values, pushing banks to prioritize sustainability in order to remain competitive.

Moreover, changes in consumer behavior, largely influenced by technological advancements and societal shifts, will also play a vital role in the evolution of banking. The demand for digital banking solutions has surged, accelerated by the COVID-19 pandemic, leading to a preference for remote services over in-person interactions. Banks are responding by enhancing their digital platforms, providing seamless user experiences, and implementing robust security measures to protect customer data. Expect a surge in mobile banking applications, biometric authentication, and blockchain technology, which will foster greater transparency and security in financial transactions.

In essence, the future of banking will be characterized by a convergence of technology, consumer consciousness, and sustainability principles. As traditional banking structures transform to meet these challenges, financial institutions will need to leverage innovation to stay relevant and provide value to their customers. Understanding these trends is essential for both consumers and industry stakeholders as they navigate the evolving landscape of banking.

Conclusion and Key Takeaways

Understanding banking is essential for making informed financial decisions that can significantly impact one’s economic well-being. Throughout this guide, we have explored various facets of the banking system, including its roles, functions, and the intricate relationship it holds with personal finance. One of the primary functions of banks is to facilitate the flow of money within the economy, providing individuals and businesses with the necessary capital to invest and grow. This fundamental role underscores the importance of having a solid grasp of how banks operate.

The different types of banking institutions, including commercial banks, credit unions, and investment banks, offer a spectrum of services tailored to meet diverse financial needs. Understanding these distinctions can assist consumers in selecting the right banking solution for their specific circumstances. Moreover, the advent of digital banking has transformed the landscape of how we approach our financial management, enabling greater accessibility and convenience.

Additionally, we examined the significance of maintaining a good credit score, effectively managing debt, and understanding interest rates. These elements are integral to navigating the banking system successfully. Furthermore, the significance of risk assessment and the regulatory framework governing banks cannot be understated, as it ensures the stabilization of the financial system at large.

In summary, appreciating the fundamentals of banking empowers individuals to make educated choices that align with their financial objectives. As financial literacy continues to evolve, it becomes increasingly critical for individuals to engage in ongoing education in banking and finance. By staying informed, consumers can enhance their financial capabilities, ensuring that they are well-equipped to face the complexities of the banking system and its profound influence on their daily lives.